4 million renters want to buy. Can they?

Thursday, 13 Mar 2014 | 9:03 AM ET

As the housing market moves slowly into recovery, more and more Americans are gaining confidence and hoping to jump into home ownership.

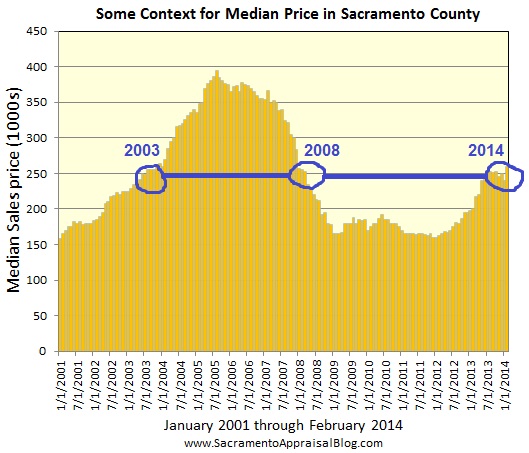

The home ownership rate has been dropping steadily since its high of 69.2 percent in 2004 to now just 65 percent. Millions lost their homes to foreclosure and millions more never entered the market, fearing falling home prices.

Now, 10 percent of U.S. renters say they would like to buy a home in the next year, according to a new report from Zillow, which surveyed renters in the nation's 20 largest housing markets.

If all the renters who said they wanted to buy a home in the next year actually did, that would represent more than 4.2 million first-time home buyer sales, about twice the number of first-timers in 2013.

First-time home buying has actually fallen to the lowest level ever recorded by the National Association of Realtors, at just 26 percent of sales in January. These buyers usually make up roughly 40 percent of the market. Interestingly, the majority of the renters who said they wanted to buy felt they could afford home ownership, despite rising home prices and rising mortgage rates.

The trouble is there is just not that much out there to buy. Home construction is still recovering at a slow pace, and prices for newly built homes are far higher on average than for existing homes.The number of homes for sale is rising slightly but is still well below historical norms across most markets.

Continue reading: http://www.cnbc.com/id/101491010